Step 1:

Knowing Yourself

Before making any financial decisions, it’s crucial to first understand your current financial situation.

Self-awareness means gaining clarity about your needs, lifestyle, spending habits, and the factors that shape your financial choices. The better you understand yourself, the easier it will be to make financial adjustments that align with your goals.

Here are five key questions to reflect on during this stage:

Question 1: Is your income stable, and do you have multiple income sources?

Having a reliable income is the foundation of financial security. Without it, uncertainties can arise. Be honest—do you have enough income right now? If not, explore ways to improve your earnings.

Additionally, relying on just one source of income can be risky. Consider diversifying your income streams. That way, if one source is affected by an economic downturn, you’ll still have others to fall back on.

Question 2: What are your assets and liabilities?

Take time to list down what you own—properties, stocks, bonds, savings, or other investments. These are your assets.

At the same time, review your liabilities—mortgages, debts, monthly bills, subscriptions, and other financial obligations.

Understanding both your assets and liabilities will give you a clear picture of your financial standing, which is essential when creating a financial plan.

Question 3: Do you have dependents who rely on you financially?

Think about whether there are people depending on you for financial support—like your spouse, children, or other family members. If you have dependents, your financial plans should prioritize their well-being, not just your own.

Consider this: If something were to happen to you, would your loved ones be financially secure?

Question 4: When do you plan to retire, and are you ready for unexpected retirement?

The ultimate goal of financial planning is to achieve financial freedom—being able to retire when you choose, without worrying about money.

However, retirement isn’t always planned. Health issues or accidents can lead to involuntary retirement. It’s important to be ready for both:

• Voluntary Retirement: When do you want to retire, and what kind of lifestyle do you envision? Will your savings support it?

• Involuntary Retirement: If you’re forced to stop working unexpectedly, can your current financial resources sustain you?

Question 5: Do you plan to have a family in the future?

Having children is a blessing, but raising a family requires significant financial preparation.

If you’re married or planning to settle down, ask yourself—do you want kids? If yes, are you financially ready to support their growth and education? If you already have children, evaluate whether your finances can provide them with a stable and secure future.

Final Thoughts:

Understanding yourself and your financial situation is the first step toward making informed financial choices. Take some time to reflect on these five questions. Your answers will serve as a strong foundation as you move forward in your financial planning journey.

Step 2:

Setting Your Financial Goals

Now that you have a clearer understanding of your financial situation, the next step is to define your financial goals.

A financial goal is a specific target you want to achieve, expressed in terms of money. Goals can differ for everyone. Some might focus on paying off debts, while others dream of early retirement.

You may be thinking, “I get it, I need goals—but I don’t know where to start. Can you help?”

You’re not alone! In our experience, nearly half of the people we meet are unsure of their goals. Many assume their financial advisor will handle everything for them.

If you’re feeling the same way, don’t worry—we’ll guide you through it!

Life in 28,000 Days

Did you know the average human lifespan is about 28,000 days (approximately 76-80 years)?

Let’s break this down into four life phases:

• 0 to 20 years: Focused on learning, playing, and growing.

• 20 to 40 years: Building a career, buying your first car and home, getting married, and raising children.

• 40 to 60 years: Possibly changing jobs or starting a business. You may buy a second car or house, and your children are likely finishing their studies.

• 60 to 80 years: Ideally, this is your retirement phase.

Notice something?

• 0 to 20 and 60 to 80 are the most critical periods—because there’s usually no income during these times.

• This means that the 14,000 days from age 20 to 60 is when you must build the wealth that will support you and your loved ones for a lifetime.

Example:

If you’re already around 35 years old, you’ve used up a big chunk of those 14,000 days. Time is ticking, and your money decisions become more urgent.

4 Universal Financial Fears

During this working phase, we often face common fears that can shape our financial goals:

Question 1: What if I can’t work until 60?

• Accidents, illnesses, or unexpected life events could prevent you from working.

• Goal: Create a backup income source to replace your earnings if you can’t work.

Question 2: What if I don’t live to 60?

• If you pass away early, what happens to your loved ones?

• Goal: Protect your family with life insurance to ensure they are financially secure.

Question 3: How much money do I need to retire?

• Retirement costs vary for everyone, but it’s vital to plan early.

• Goal: Start saving so you can maintain your desired lifestyle when you retire.

Question 4: Will my children have a good start in life?

(Note: This goal applies if you have or plan to have children.)

• Education is key to a child’s future.

• Goal: Save for your children’s education so they have a strong foundation.

Aligning Your Goals with Your Dreams

Beyond these basic goals, you may also have personal financial dreams, like:

• Owning a luxury car or dream home

• Traveling the world.

• Pursuing hobbies.

• Leaving a legacy for your family.

• Supporting charitable causes.

Final Thought:

A goal without a plan is just a wish.

Now that you know the common fears and key goals, write down your personal financial goals.

This will give you a clear direction as you move forward.

In the next stage, we’ll work on building financial strategies to turn your goals into reality!

Step 3:

Developing Your Financial Strategy

In the previous chapters, we discussed the four common financial goals that most people aim for. Now, the big question is: How do you actually achieve them?

We often hear advice like, “Invest and take advantage of compound interest,” but at the same time, we hear cautionary tales of people losing money by blindly following investment advice from so-called financial experts.

The truth is, you will encounter many different financial strategies throughout your life. It’s ultimately your responsibility to decide what works best for you. Always consult a trusted financial advisor and do your own research to validate the approach before committing.

Now, let’s introduce you to an investment approach called The ABCD Investment Strategy. You can decide if it aligns with your financial goals.

The ABCD Investment Strategy

There are four key things to understand when building an investment strategy:

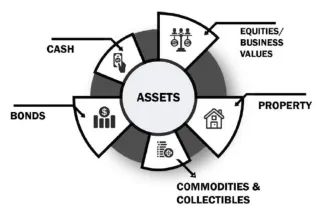

1. What Asset Classes Can You Invest In? (Refer to the first image)

There are five main types of assets that you can invest in:

1. Property – Real estate is a popular choice across generations as it generally keeps up with inflation.

2. Equities (Stocks) – Ownership in companies, either bought through stock markets or inherited. This is often considered a growth-oriented investment.

3. Bonds – Fixed-interest instruments issued by governments or companies. They are typically seen as safer compared to stocks.

4. Commodities – Natural resources like gold, oil, and agricultural products. Prices fluctuate based on supply and demand.

5. Cash – The most liquid asset. Cash provides security and flexibility but does not offer growth.

1. What Asset Classes Can You Invest In?

There are five main types of assets that you can invest in:

1. Property – Real estate is a popular choice across generations as it generally keeps up with inflation.

2. Equities (Stocks) – Ownership in companies, either bought through stock markets or inherited. This is often considered a growth-oriented investment.

3. Bonds – Fixed-interest instruments issued by governments or companies. They are typically seen as safer compared to stocks.

4. Commodities – Natural resources like gold, oil, and agricultural products. Prices fluctuate based on supply and demand.

5. Cash – The most liquid asset. Cash provides security and flexibility but does not offer growth.

2. Understanding Risk, Liquidity, and Returns

Each asset class differs in risk, liquidity, and expected returns:

Liquidity – How easily you can convert an asset into cash.

Volatility – How unpredictable or risky the asset’s price movement is.

Yield – The expected returns from the investment.

A quick comparison:

1. Property

• Liquidity - Highly illiquid

• Volatility - Market-dependent

• Yield - Stable returns

2. Equities (Stocks)

• Liquidity - Generally illiquid

• Volatility - High risk

• Yield - High returns

3. Bonds

• Liquidity - Market-dependent liquidity

• Volatility - Market-dependent

• Yield - Stable returns

4. Commodities

• Liquidity - Market-dependent liquidity

• Volatility - High risk

• Yield - High returns

5. Cash

• Liquidity - Highly liquid

• Volatility - None

• Yield - Low returns (or none)

Understanding these characteristics allows you to make informed decisions when building your investment portfolio.

3. Your Risk Appetite Over Time

Your risk appetite changes as you age. When you are younger, you might be comfortable taking more risks, investing in stocks and commodities. However, as you approach retirement, you would likely prefer safer, more liquid investments like bonds or cash.

This is because the ability to recover from losses diminishes with age. An illiquid asset can become a burden later in life. For example, imagine being 80 years old and having to deal with a tenant calling you about a leaking toilet. At that stage, you’d likely prefer receiving a steady income without the hassle of managing physical properties.

4. The ABCD Investment Strategy

The ABCD strategy is a gradual transition from high-risk, illiquid assets to low-risk, liquid assets as you near retirement. Here’s a breakdown:

Strategy | Time Period | Suggested Investments

A – Aggressive | Years 1 – 7 | Equities, Property, Commodities

B – Balanced | Years 8 – 15 | Equities, Emerging Market Bonds, Property

C – Cautious | Years 16 – 23 | Developed Market Bonds, Cash, Property

D – Defensive | Years 24 – 25 | Government Bonds, Cash

How to Apply It:

1. Years to Retirement – 2 = Number of Years for ABC Investing.

2. Divide that number by 3 to get the duration of each phase (A, B, and C).

3. Phase D starts 2 years before retirement, focusing on cash and secure bonds for income stability.

Example: If you are 25 years from retirement:

• 25 – 2 = 23 years for phases A, B, C.

• 23 ÷ 3 ≈ 7.6 years per phase.

You would spend roughly 7 years each in Aggressive, Balanced, and Cautious phases before shifting into the Defensive phase 2 years before retirement.

Key Takeaway:

As you age, your priority should shift from growth to securing a stable income. You want your retirement years to be stress-free, with cash flow from your investments, rather than worrying about their value or management.

Insurance as a Complementary Financial Tool

While investments are crucial, insurance is equally important in your financial plan. Insurance allows you to transfer certain financial risks to a third party. Over the years, insurance companies have developed various products tailored to different needs. These products can complement your investments and protect your financial goals.

In the next stage, we’ll explore different types of insurance products and how they can help you meet your financial objectives. We’ll guide you through understanding how much insurance you need and how to choose the right policies.

Step 4:

Understanding Insurance & How Much You Need

Let’s be honest—discussing death, illness, or accidents isn’t something people enjoy. Most of us prefer to believe, "It won’t happen to me." However, we see these situations unfolding around us every day.

We recognize that insurance provides financial security, yet with so many options available, choosing the right one can feel overwhelming. But here’s a question for you: How many types of insurance products actually exist?

Many people assume there are countless options since different companies offer multiple plans. But in reality, there are only four essential types of insurance that address our biggest financial concerns:

1. Life Coverage

"You die, I pay."

Provides financial support to loved ones in case of death.

2. Income Protection

"You fall sick, I pay."

Ensures financial stability if illness or disability affects your ability to work.

3. Retirement Planning

"You retire, I pay."

Helps secure a stable income during retirement.

4. Education Planning

"Your kids go to college, I pay."

Ensures your child’s education expenses are covered.

At any stage in life, one or more of these products will likely be relevant to you.

HOW MUCH INSURANCE COVERAGE DO YOU NEED?

There’s a simple Rule of Thumb for Insurance, just like the well-known guideline of drinking 8-10 glasses of water daily for good health. Insurance coverage also follows a standard formula based on income:

Life Insurance: Coverage should be 10x your annual income

Income Protection: Should be 5x your annual income

Retirement Planning: Allocate 20% of your income

Education Planning: Set aside 5% of your income

For instance, if you earn ₱240,000 per year, your life insurance coverage should ideally be ₱2,400,000.

INSURANCE NEEDS CHANGES OVER TIME

Your insurance requirements evolve depending on three key factors:

1. Marital Status

Once married, financial planning isn’t just about you—it includes your spouse.

If both partners are earning, financial strategies will need adjustments.

2. Income

This includes salary, business earnings, and passive income.

Higher income generally means higher coverage is needed.

If you don’t have an income, you may still need insurance, but the coverage will be lower.

3. Dependents

If you have children, aging parents, or anyone relying on you financially, your coverage should be sufficient to support them in case of unforeseen circumstances.

WHAT’S NEXT?

To determine your ideal coverage, take the Initial Assessment to know more about what suits your needs based on the three key factors.

Step 5:

Review & Update Your Financial Plans

Every now and then, you might get a call from your financial advisor suggesting a “policy review.” It’s natural to wonder, “Are they just trying to sell me something again?”

But rest assured—that’s usually not the case. Reviewing your policies is an essential part of sound financial planning. Step 5 of the financial planning process involves regularly assessing your financial plans to ensure they continue to align with your goals. As your life circumstances and objectives evolve, your financial strategies and products may need to be adjusted as well.

WHEN SHOULD YOU REVIEW YOUR FINANCIAL PLAN?

You might ask, “How often should I check in with my advisor? Every 6 months? Once a year? Every couple

of years?”

While some suggest regular intervals, the best time to review your financial plan is when you experience a significant change in your income or personal life.

Here are some common situations that call for a policy review:

Changes in Income

An increase or decrease in your earnings can impact your coverage, especially your income protection.

Life Milestones

Major events such as getting married, having children, retiring, graduating, or changing jobs often bring new responsibilities and financial obligations. These shifts may require adjustments to your existing policies or new solutions to fit your current needs.

IF NOTHING CHANGES, NO ACTION IS NEEDED

If your income and life situation remain the same, there’s usually no need to alter your financial plan. However, if an advisor reaches out for a review, simply let them know if nothing has changed. But if there has been a shift in your life or income, it’s a good idea to hear them out—you might discover financial solutions that better suit your new situation.

After all, there’s no harm in listening to new options, right?

FOLLOW US

SERVICES

FINANCIAL PLANNING

LIFE INSURANCE

HEALTH INSURANCE

MUTUAL FUNDS (MF)

UNIT INVESTMENT TRUST FUND (UITF)

GROUP LIFE INSURANCE

TALK TO AN ADVISOR

AWARDS AND RECOGNITIONS

CONTACT US

OUR TEAM

OUR LOCATION

OUR ADVISORS

CAREERS

Copyright 2025. Bright Light Fire. All Rights Reserved.